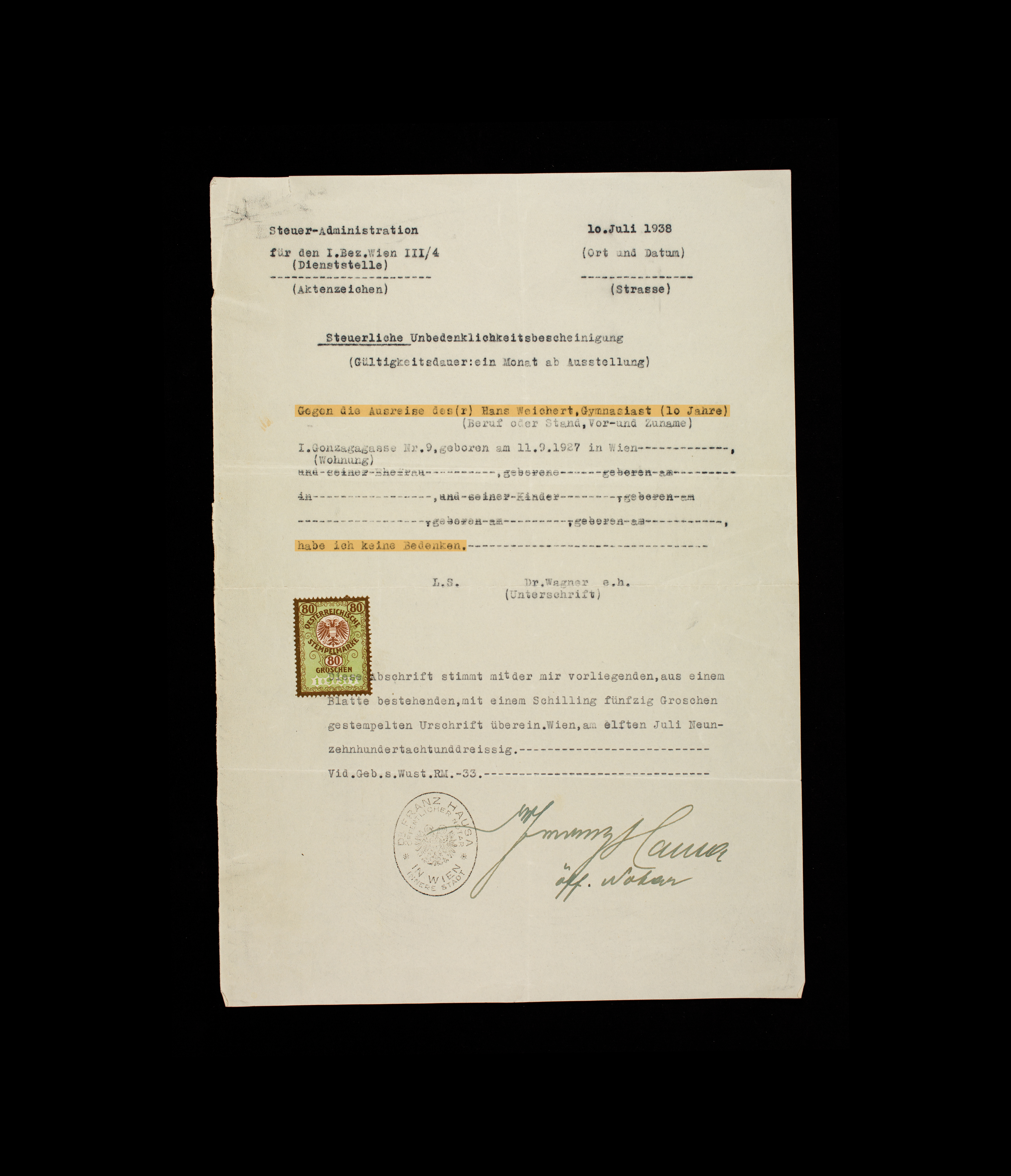

Papers in order

Even 10-year-old Hans must certify his taxes are paid

-

“I do not have any reservations regarding the emigration of Hans Weichert (10 years old) [...].”

Vienna

Jews wishing to escape the chicanery and physical danger under the Nazis by emigrating had to procure a large number of documents to satisfy both the Nazi authorities and the authorities in the country of destination. In order to obtain permission to leave Germany, applicants had to prove that they did not owe any tax money to the Reich. In addition to the taxes levied on all citizens, prospective emigrants had to pay the co-called “Reich Flight Tax.” Originally introduced during the Great Depression of the late 1920s and early 1930s, the original purpose of the tax was to prevent capital flight from further depleting the national coffers. Under the Nazis, its main purpose was to harass and expropriate Jews. The tax authorities under the Nazi regime certainly did a thorough job. When the Weichert family of Vienna, consisting of the lawyer Joachim Weichert, his wife Käthe, and the couple’s two children, Hans and Lilian, prepared to leave, a tax clearance certificate was issued even to the ten-year-old son. The document was valid for one month. Having all required documents ready and still valid by the time their quota number came up was an additional challenge faced by those wishing to emigrate.

SOURCE

Institution:

Leo Baeck Institute – New York | Berlin

Collection:

Weichert Family Collection, AR 25558

Original:

Box 1, folder 2